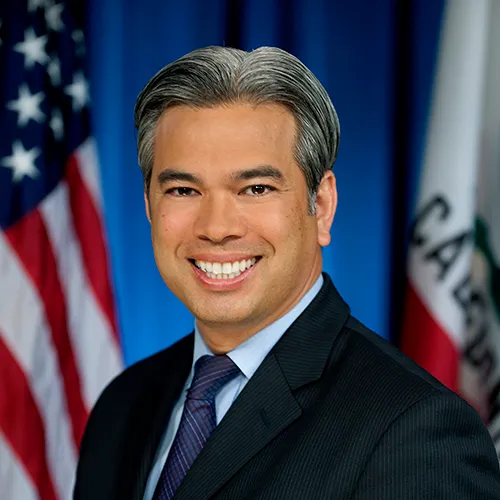

California AG Bonta Secures $3.9M Settlement with Robinhood Over Crypto Practices

In a landmark decision, California AG Bonta has successfully secured a $3.9 million settlement with Robinhood, the popular online brokerage known for democratizing access to financial markets, including cryptocurrency. This resolution is part of a broader enforcement action concerning Robinhood’s operational practices and its impact on consumers.

Background of the Case

Robinhood, an app-based trading platform, has gained significant popularity in recent years due to its user-friendly interface and commission-free trading. While the company is well-known for stock trading, it has also expanded into the cryptocurrency market, allowing users to buy and sell assets like Bitcoin, Ethereum, and other digital currencies.

However, with its growth came a series of regulatory issues and consumer complaints. The legal action spearheaded by california AG Bonta highlights Robinhood’s operational lapses, particularly concerning misleading communications with users, failure to provide adequate customer support, and technological outages that left many investors unable to access their accounts during key trading periods.

Key Allegations Against Robinhood

The settlement stems from various allegations against Robinhood:

- Misleading Information: The California Department of Justice accused Robinhood of failing to provide accurate, transparent information to users about the risks associated with trading cryptocurrencies and stocks. This led to misunderstandings among novice investors about the true nature of their investments.

- Technology Outages: Robinhood experienced significant platform outages, especially during crucial market events in 2020. These outages resulted in users being unable to access their accounts or make trades, causing them to miss out on opportunities or suffer financial losses.

- Customer Support Failures: Robinhood was also criticized for not providing adequate customer service. Users reported long wait times and unresponsive support when trying to resolve issues with their accounts or trades.

- Operational Failures: The platform allegedly failed to comply with key regulations, including proper vetting of customers and ensuring the safety of trades, particularly for cryptocurrency transactions.

Settlement Details

The $3.9 million settlement is a significant outcome, intended to compensate affected users and serve as a deterrent for other companies operating in the financial and crypto spaces. According to the terms, Robinhood has agreed to improve its customer service infrastructure, enhance its technical capabilities to prevent future outages, and provide clearer communication about the risks of trading cryptocurrencies.

The settlement also includes:

- Consumer Relief: A portion of the $3.9 million will go towards compensating California users who were impacted by Robinhood’s practices.

- Regulatory Compliance: Robinhood is required to implement more stringent compliance measures to ensure that its trading platform meets California’s legal standards, particularly for cryptocurrencies.

- Platform Improvements: Robinhood will invest in upgrading its technology to avoid future outages and improve customer support mechanisms.

Implications for the Cryptocurrency Market

This settlement highlights a growing trend in regulatory scrutiny over platforms that facilitate cryptocurrency trading. With more consumers entering the crypto space, regulatory bodies are paying close attention to ensure that platforms provide transparent and secure trading environments.

Attorney General Bonta’s decision is also a reminder for companies like Robinhood that compliance with regulations, especially in the volatile and often unpredictable world of cryptocurrency, is non-negotiable. This settlement could encourage other states to review the practices of similar trading platforms, leading to broader industry reforms.

Conclusion

The $3.9 million settlement between Attorney General Rob Bonta and Robinhood is a crucial moment for the cryptocurrency and stock trading industry. It reinforces the importance of consumer protection, transparency, and adherence to regulatory standards. As Robinhood moves forward, the company is expected to make significant changes to its platform, ensuring a safer and more reliable experience for both stock and crypto investors.

This case serves as a strong reminder that while financial platforms can provide immense opportunities for everyday traders, they must do so responsibly and in full compliance with the law.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Polkadot

Polkadot  WhiteBIT Coin

WhiteBIT Coin  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Pi Network

Pi Network  Uniswap

Uniswap  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo